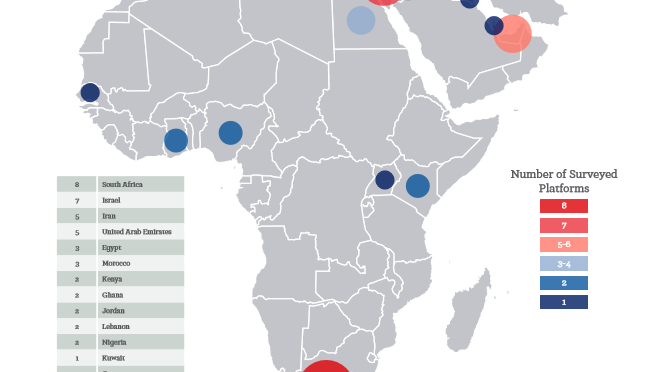

Peer-to-peer (P2P) lending in the Middle East has grown significantly, driven by technological advancements, favourable regulation, and strong demand for alternative financing. The United Arab Emirates (UAE) and Saudi Arabia are emerging as key markets, largely due to their fintech initiatives and supportive government policies. In the UAE, platforms like Beehive, the first to receive […]...