Real Estate Crowdfunding SaaS

By Pawel Szewczyk | 19/08/2025

Real Estate Crowdfunding SaaS: How Software is Changing Property Investment

Real estate has always been a proven path to wealth, but high entry costs and limited access have kept many investors on the sidelines. That’s changing, thanks to Real Estate Crowdfunding SaaS platforms that make it possible to invest in property with just a few clicks.

In this article, we’ll break down how these platforms work, their advantages, real-world case studies, and where the industry is headed.

What is Real Estate Crowdfunding SaaS?

Real Estate Crowdfunding SaaS (Software-as-a-Service) is a cloud-based investment platform that connects property developers with a network of investors. Instead of one party funding an entire project, many investors contribute smaller amounts, giving more people access to lucrative real estate deals.

The SaaS model allows everything to happen online, including:

- Deal listings

- Investor onboarding (KYC/AML)

- Automated payments

- Performance tracking

How Real Estate Crowdfunding SaaS Works

- Project Fundraising: developers upload details like location, cost, ROI, LTV and timelines.

- Investor Selection: browse and pick investment opportunities that match their goals.

- Fractional Funding: investors buy fractional shares, starting from £500.

- Automated Management: handles contracts, compliance and transactions.

- Ongoing Returns: earnings are distributed via rental yields, capital gains, or profit-sharing.

Benefits for Investors

- Transparency: Investor dashboards allow you to monitor portfolio performance.

- Diversification: spread risk across different property types and markets.

- Low Capital Requirement: invest with a fraction of traditional costs.

- Global Reach: access opportunities anywhere, anytime.

Why SaaS is the Key Enabler

SaaS transforms real estate crowdfunding by offering:

- Scalability: handle thousands of investors with minimal overhead.

- Automation: reduced manual work through smart contracts and payment systems.

- Compliance Tools: built-in KYC/AML and tax reporting.

- Cross-Border Investment: reach global investors with ease.

Challenges & Risks to Consider

- Regulatory Complexity: varies by region.

- Market Risks: economic downturns can affect returns.

- Trust Factors: platforms must vet projects thoroughly.

Future Trends in Real Estate Crowdfunding SaaS

- Blockchain & Tokenisation: faster, more liquid property shares.

- AI Investment Insights: smarter deal selection.

- Virtual Reality Tours: immersive property exploration.

Real Estate Crowdfunding SaaS is democratising property investment, making it easier for everyday investors to participate in real estate markets once reserved for the wealthy. For developers, it’s a faster, more flexible way to raise capital and reach a global audience.

Case Studies: Real Estate Crowdfunding SaaS in Action

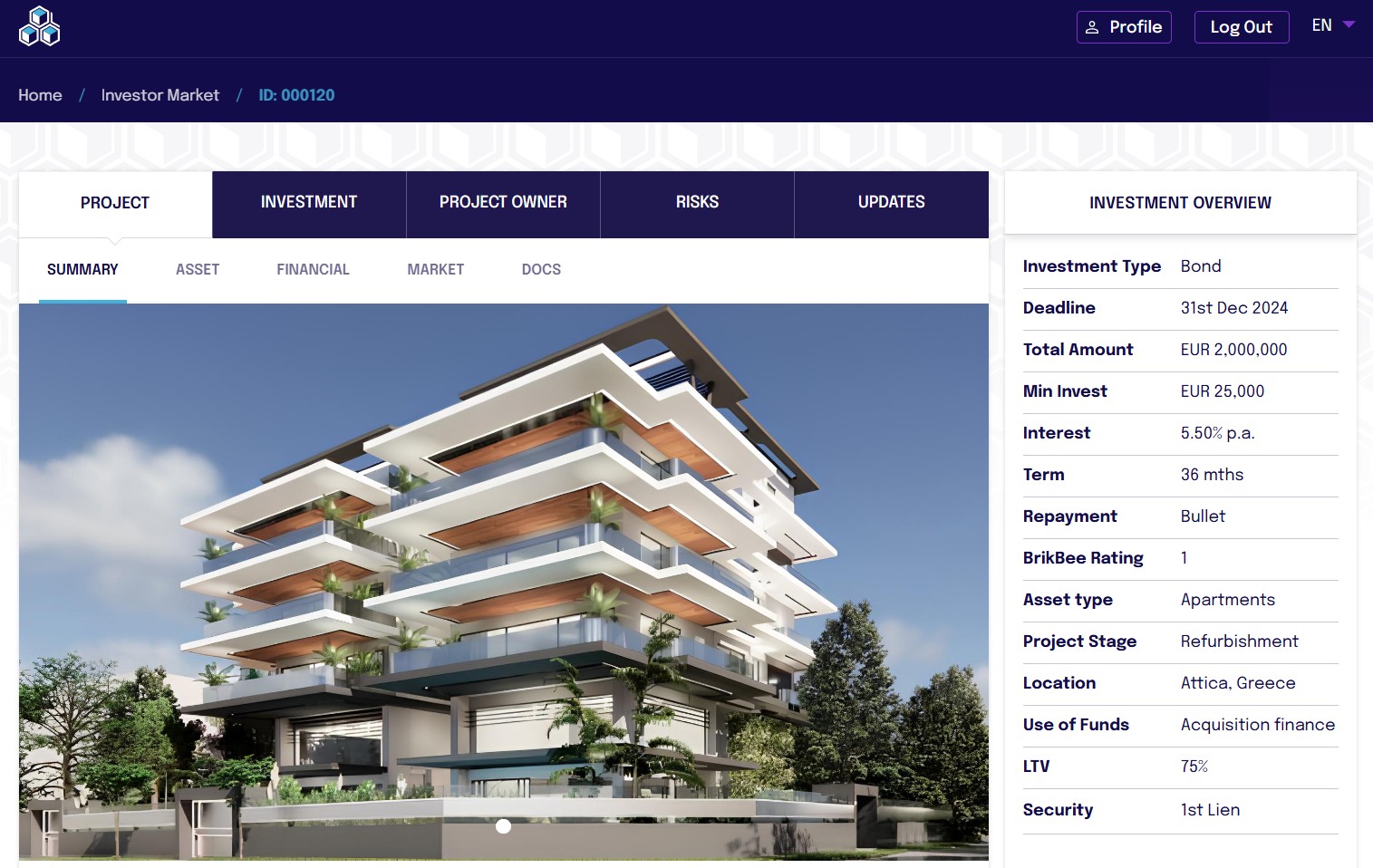

Brikbee (awaiting launch)

BrikBee is a real estate crowdfunding platform in Greece that connects investors with project owners. The company provides a new and flexible way for developers to raise capital and gives investors the chance to fund real estate projects. BrikBee handles the screening of projects and owners, evaluates business plans, and pre-negotiates investment terms.

Achievements and Unique Selling Points:

- First in Greece: BrikBee was the first platform in Greece to receive a crowdfunding service provider licence, which it obtained in September 2024.

- Awaiting Launch: BrikBee is currently awaiting final regulatory authorisations and expects to fully launch its services in 2025.

- Regulatory Oversight: it operates under the authorisation and supervision of the Hellenic Capital Market Commission.

- Expertise: BrikBee highlights its team's deep expertise in both finance and real estate, which it uses to screen projects and offer innovative funding solutions.

- Risk Disclosure: We emphasise that crowdfunding investments carry risks, such as the potential loss of capital and liquidity risk, and advise investors to seek independent advice.

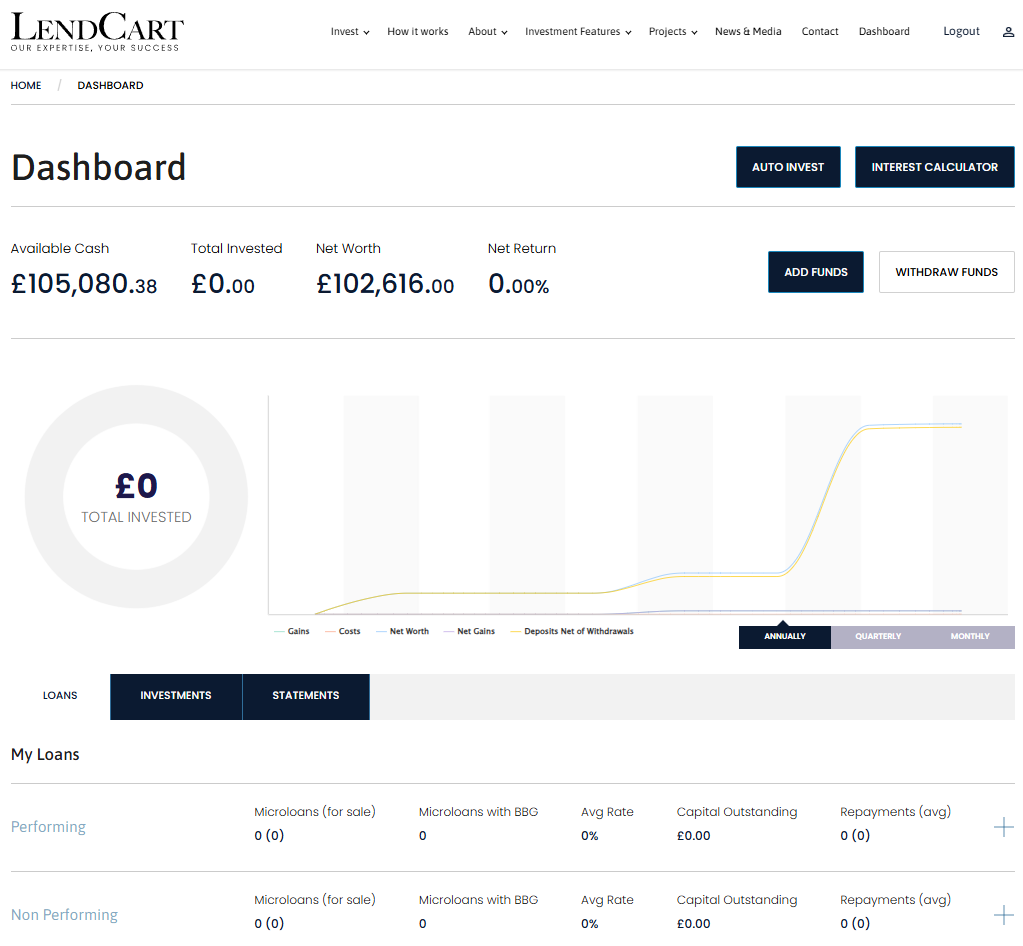

LendCart

LendCart is a real estate investment platform that connects investors with property developers for projects in the UK. The platform focuses on secured lending opportunities, offering the potential for double-digit annual returns. Investments are protected by first and second legal charges on UK properties.

LendCart's Unique Selling Points:

- Co-investment and Aligned Interests: LendCart co-invests in every project and only receives returns once the project is completed, which aligns its interests with those of its investors.

- Transparency and Due Diligence: LendCart emphasises transparency, allowing investors to know exactly how their money is being used. They have a team of experts who perform a bespoke due diligence process.

- No Investor Fees: LendCart does not charge investors fees on their investments.

- Security: investments are secured by first and second legal charges on properties, along with personal guarantees from the borrower.

- Double-Digit Returns: of between 8% and 12% per annum.

- Minimum Investment: is typically £10,000, though this may vary by project.

- Technology: LendCart is described as the UK's first AI-powered, voice-enabled real estate lending platform, using intelligent automation and AI to simplify the investment process.

Sourced Capital (former client)

Sourced Capital is a peer-to-peer lending platform that helps investors fund a diverse portfolio of UK-based property projects. It facilitates loans from investors to property developers, and investors receive interest on their loans. The platform offers various investment options, including Cash, Innovative Finance ISA (IFISA), and SSIP/SSAS Pension, with a minimum investment of £1,000.

Sourced Capital's Key Achievements and Unique Selling Points:

- Money Raised: over £85 million worth of property developments through their passive investments and have raised over £44 million for almost 70 projects.

- Returns: up to 12% per annum.

- Security: Investments are secured by a first legal charge against the property and a personal guarantee from the borrower.

- Track Record: Sourced claims a track record of zero fees and zero losses, and a 100% repayment rate. However, they also clearly state that capital is at risk and is not covered by the FSCS.

Propfin (former client)

Propfin is a lending company that specialises in various financial solutions, including bridging finance, commercial finance, development finance, business finance, and exit finance. They offer loans from £50,000 to £3 million with a maximum term of 12 months, primarily using first charges.

Propfin's unique selling proposition (USP) is a combination of their extensive experience and their advanced technology solutions. Their USP includes:

- Deep Property Development Experience: Their team has over 40 years of experience in UK property development, giving them a unique understanding of the challenges and needs of developers.

- A Sophisticated Portal: Propfin has created an advanced online portal for developers and brokers.

- Integrated Technology: This portal is integrated with Salesforce, allowing brokers to efficiently match complex development projects with specialist funders and receive funding quotes. This technological approach streamlines the process, making it faster and more efficient for their clients.

- Tailored Financial Solutions: This combination of industry knowledge and technology enables them to provide tailored financial solutions and build long-term relationships with their clients.

Peer Funding (former client)

Peer Funding Limited is a peer-to-peer business lending platform serving the UK market.

The PFL trading platform is a multi-asset class service offering, catering to short-term cash flow and long-term growth capital lending. The platform launched with the following products, with more to follow:

- Business Loans

- Secured Business Loans

- Selective Invoice Finance

- Selective Debtor Finance

- Property Bridging Loans

- Property Development Loans

For investors, there is an opportunity to build a diverse portfolio across a range of short- to long-term investments to match their risk and return aspirations.

For borrowers and professional advisers, there is a solution for most business finance needs. A one-stop shop means Peer Funding is able to build long-term relationships with its customers.